DURATION

6 months

MEMBERS

Self: Primary designer

Michelle Ismail: Design collaborator

Smitha Papolu: Design manager

James Theisen: Content designer

TASKS

Customer research, product audit, prototyping & wireframe, UI design, micro-interaction, development hand-off, usability testing

Reimagining income tax in QuickBooks to boost confidence in tax literacy

PROJECT BACKGROUND

Self-employment is a mindset who see themselves as the business. Self-employed individuals spend their time thinking about how to achieve financial stability and taxes and IRS are anxiety-inducing for them because of heavy regulation and rigid systems.

1/3 of QuickBooks companies have a self-employed mindset, with sole proprietors being the largest customer base in QuickBooks platform across developed markets. With the recent boom in self-employed businesses started fueled by the pandemic, there are more new self-employed users than ever who are filing taxes for the first time. This project help make income taxes more approachable and digestible to new and pre-existing businesses.

HYPOTHESIS

By directly addressing this most-represented yet underserved group with gaps between their bookkeeping and income tax, it will improve retention in product and strengthen confidence of the business owner.

"I would say I'm not super knowledgeable about taxes, I probably am not getting all of my tax deductions and things like that."

Research

LEARNING GOAL

We set out to understand how new tax filers approach tax prep and planning.

What existing knowledge do they have, where do they need help most, and how can QBO best lend a hand?

Can SE tax filers understand how their money ladders up to their business taxes?

METHOD

20 interviews with self-employed participants

8 web users, 12 mobile users

Used criteria such as new tax filers, new business owners, novice to intermediate level of tax and accounting knowledge

QuickBooks users and non-users

Rapid Iterative Testing and Evaluation [RITE]

Multiple prototype versions

AB tested

Past research review

IDENTIFYING OUR USER GROUPS

3 tax filer archetypes

Tax-ready

“Every now and then, I’ll come in here to see what’s going on. I’ve been doing my taxes since 2015, so this is quite routine.”

Been in business for several years

Has filed taxes before

Still finds value in tax tab

Feels confident tax filing ability and knowledge

Feels compelled to be in the know

Feels empowered to take action with business money

Semi-proficient

“I want to be compliant, I want to do the right things, I want to maximize my tax deductions...as a newer small business owner you just don't even know what you don't know”

Understands basic deduction and tax laws

Compiles tax documents throughout the year

Meets with tax expert at the end of the year

Feels unsure about how to maximize deductions

Feels confident about basic tax tasks

Feels nervous about having accurate numbers

Tax anxious

“I don’t know anything about the process of filing taxes and have to figure out what it means to file taxes as an independent owner.”

Newly in business

Has never filed taxes before

Hires a tax expert/accountant to manage finances

Feels overwhelmed by the idea of taxes

Feels anxious when tax time approaches

Feels in the dark about their tax situation

PROBLEM STATEMENT

I am an inexperienced (first time) SE tax filer

trying to get an understanding of how to maximize my deductions to lessen the impacts of tax liability

but I have no clue how to begin and I’m scared to get it wrong

because I am a novice and I’d much rather focus on what I love doing than running the business (“I’m an artist not an accountant”)

Which makes me feel mentally exhausted, lost, and anxious—like I have to figure it out on my own, on top of everything else

Findings

FINDING 1 | Starting

All SEs have a baseline understanding of maximizing deductions for tax purposes

Self-employed users say maximizing deductions is the most important thing to stay afloat when it comes to their taxes.

“I know that I miss out on a lot of deductions [...] so to be able to see how [my expenses] adds up to a deduction is really valuable.”

“it makes you want to hit on all of those deductions and makes you want to categorize your transactions so you can maximize those deductions”

TAKEAWAYS

Getting the most out of tax deductions is a main way new businesses stay afloat

Seeing that they can maximize their deductions using QB increases trust in us and confidence at tax time

DESIGN OUTCOME

Structured guide

Overview information about tax time and how QB can help sort their transactions and get ready

Deduction categories examples

Examples of what SEs can deduct let those who know they need to maximize their deduction but don’t know how know what to do

FINDING 2 | Knowing

Unsure where to start, new filers seek structure in their tax journey

Providing SEs with clear steps and the right information helps them get started on taxes with confidence.

“I honestly just know the basics, because going into it my first year... it seems like a lot to go through... it [feels] complicated.”

“[I want to know] what exactly I have to do for tax season, what documents and numbers I need to put together, in a step by step instruction sheet”

TAKEAWAYS

Getting started with taxes is the largest barrier. The uncertainly around them is so high that they put off taxes entirely.

SEs feel empowered to take action on taxes when given an easy starting point

Demystifying taxes made SEs feel more in the loop even when getting help from experts

DESIGN OUTCOME

Deduction call to action

CTAs surfaced at the top view allows quick and visible access points for SEs to claim deductions. Content incentivizes engagement

Different deduction categories

Surfacing different deduction categories with clear CTAs allow SEs to know what they can deduct and how to take action

FINDING 3 | Doing

Hands-on tax work boosts confidence, creating forward momentum in their actions

As customers explored their taxes, they were empowered to do more and engage in the next steps of their tax journey.

“[seeing deduction breakdown] has more impact than when my accountant tells me to put money away”

“I would probably go over my deductions and make sure there’s nothing wrong with them... [then] I would continue if I had any deductions as to add, I would do that”

TAKEAWAYS

Spending time actively engaging in tax work, SEs were able to deepen their knowledge quickly

SEs had more engagement when presented with clear break down of the tax process

Taking small steps throughout the year (instead of doing everything at tax time) builds confidence and a sense of control

DESIGN OUTCOME

Task call to action

Relevant CTAs associated with each deduction category is at the top to give a clear action for SEs to take and know how to get started

Detail of deductions

Breakdown of their deductions give SE a better understanding of where they stand with their deductions empowering them to be in control

FINDING 4 | Understanding

SEs seek validation that they’ve done the most to save at tax time

SEs seek assurance that they have covered all their bases and are doing as much as possible to save during tax time.

“Because it’s for business it... I expected that [QuickBooks] would be confusing, but it’s nice to know... it looks like it’s pretty straightforward and easy to use. Um, so yeah, I would definitely use that for my business in the future.”

“That makes things a lot easier, being able to see all that information right in front of me like right away.”

TAKEAWAYS

SEs want to know that they’re doing everything they can for their business and see the progress and direct impact of their actions

SEs found the digestible but comprehensive picture of their business a confidence booster

DESIGN OUTCOME

Deduction big picture

Clear visualization of the breakdown of their deductions and how it affects their income and taxable profit

Finish line celebration

CTA changed to indicate there’s no further transactions to categorize, thus confirming they’ve maximized their deductions

Web Design

Headline summary card iterations – Web

APPROACH

Highlighting deduction related information and driving action

As the first element a user sees when visiting the page, this overview card is designed to serve as a summary of their income and deduction amounts, as well as be the access point to drive the most important action, categorizing transactions.

Bar graph

After many iterations of different visualizations and designs with explorations in various data visualization options, the final design incorporates an elegant and easy to understand bar graph showing the proportional relationship between income and deduction amounts with clearly labeled legends.

Dashed line

After several iterations, and rounds of user testing, we landed on the treatment of dashed lines in the bar graph to indicate transactions that are unreviewed. The purpose of this section is to highlight transactions that still require action from users. The dashed lines show the potential of what the total amount could be, while still maintaining accuracy of what’s reviewed in their books and what’s not.

In-context CTA

By placing our main call to action within context of the data, it quickly captures the user’s attention and provides a quick access point to take action to resolve unreviewed transactions, thus maximizing their deductions. The reward of completing this action is seeing their visualization update with reviewed transactions and being more accurate.

Deduction detail breakdown – Web

APPROACH

Drill-down of different deduction types

This section of the page is a supplemental companion to the overview summary, where users can find out more about their different deductions in detail, and they can view and make edits on their different deductions.

Collapsible drill-down

The design decision of making the drill-down an expand and collapse interaction is to highlight the main information at first glance to not overload users with information. The easily expandable cards allow users to view each category more in-depth.

Surfaced CTA

CTAs surfaced at the top view allows quick and visible access points for users to claim deductions. Content incentivizes engagement.

Mobile Design

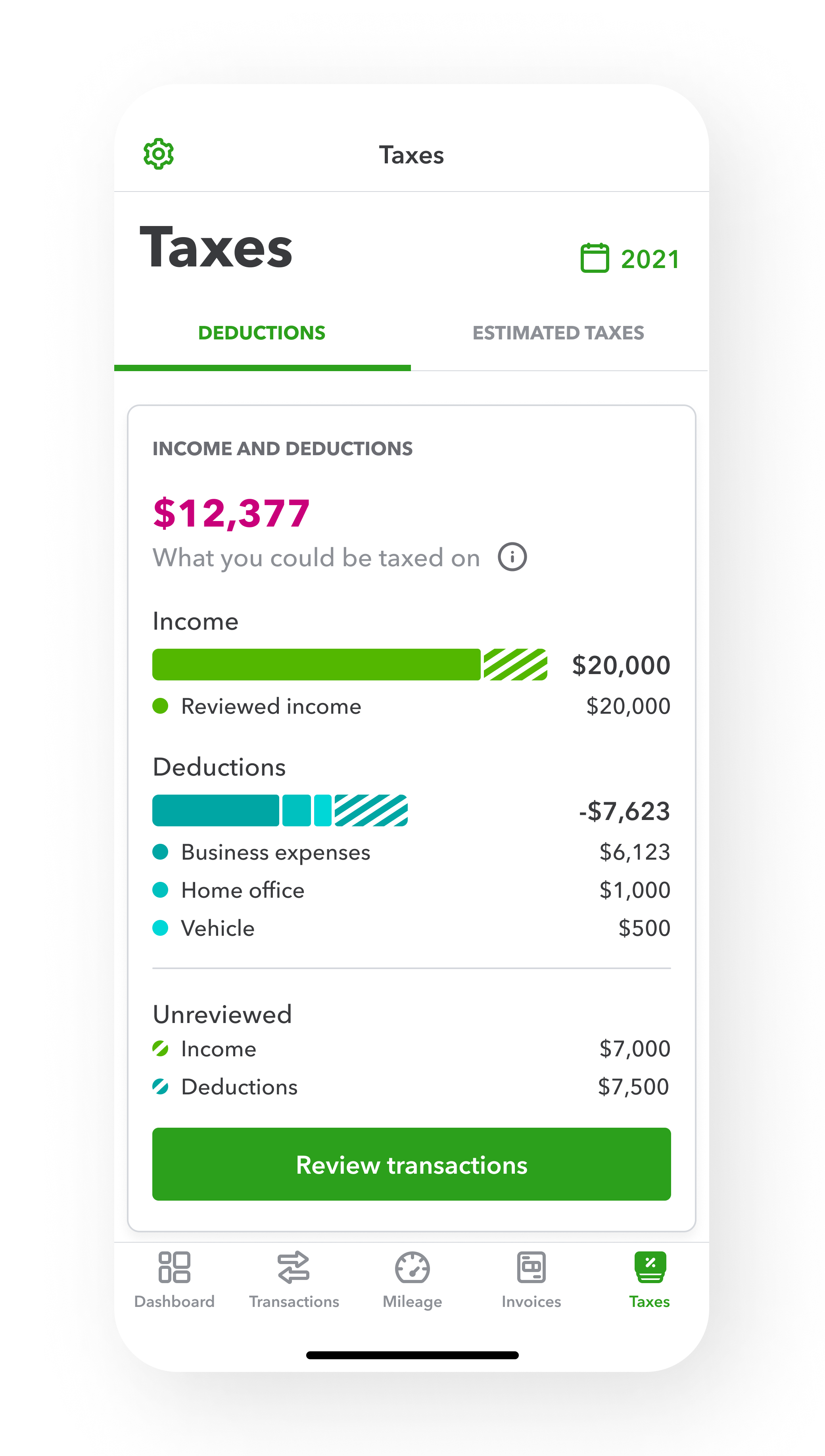

Overview summary card

APPROACH

Scaling content for mobile screen

Designing for mobile presents a new challenge that’s different from web, limited screen real estate. Being restricted by a mobile screen’s width forced us to think critically about element layouts, prioritizing crucial data first, and leveraging vertical space over horizontal.

Challenge

Finding an elegant solution to display all necessary components of a user’s tax history is the main challenge we faced. Laying out income, deduction, taxable profit, and including a clear call to action to resolve any unreviewed transactions took a lot of maneuvering and creative thinking. Another challenge was also how to scale for different phone sizes, chart size, and data value.

Solution

After several iterations, and rounds of user testing, we landed on stacking the data visualization bars vertically, utilizing the vertical scroll bar to display the chart legend. By grouping transactions and deductions that are already in their books at the top, this section acts as a source of truth of data that’s already recorded and shows income and deductions that are reviewed.

Unreviewed call out

By grouping unreviewed transactions together, and placing our main call to action within context of the data, it highlights to users of work that still needs to be done, and an access point to easily take action to resolve these transactions. Using proximity and grouping as a design tactic, we are able to call attention to these transactions, while still including them in the big picture of a user’s income and deductions.

Deduction detail breakdown

APPROACH

The previous state of the taxes tab only surfaced business expense deduction categories in a long scrolling list, without a section for other deduction types such as home office and vehicle expenses. The re-design prioritizes showing the complete picture of the user’s deductions by bringing in home office and vehicle expenses section, and uses a drill-down pattern to expose more information for each category to reduce cognitive and visual load.

Progressive disclosure

By aligning with the web design of surfacing high level summary information of each deduction category, and using a drill-down to expose more information in detail, this allows us to highlight top level summary of their deduction, and reduce cognitive and visual load on the landing page.

Widgets

Scalability

Modularize the design for global markets

(WORK IN PROGRESS)